All Categories

Featured

Table of Contents

Below is a hypothetical contrast of historical efficiency of 401(K)/ S&P 500 and IUL. Allow's assume Mr. SP and Mr. IUL both had $100,000 to conserved at the end of 1997. Mr. SP spent his 401(K) cash in S&P 500 index funds, while Mr. IUL's cash was the cash worth in his IUL plan.

IUL's policy is 0 and the cap is 12%. After 15 years, at the end of the 2012, Mr. SP's profile grew to. Yet due to the fact that Mr. IUL never ever shed cash in the bear market, he would certainly have twice as much in his account Also much better for Mr. IUL. Because his cash was conserved in a life insurance policy, he doesn't need to pay tax! Naturally, life insurance policy secures the family and offers sanctuary, foods, tuition and medical expenditures when the insured passes away or is seriously ill.

Iul Instrument

Life insurance pays a death benefit to your recipients if you need to die while the policy is in effect. If your family would face financial difficulty in the event of your death, life insurance coverage provides peace of mind.

It's not one of one of the most rewarding life insurance financial investment strategies, but it is one of the most safe and secure. A form of long-term life insurance coverage, universal life insurance policy allows you to select just how much of your costs goes towards your fatality benefit and exactly how much enters into the plan to accumulate cash value.

In addition, IULs permit policyholders to secure loans versus their policy's cash value without being exhausted as earnings, though overdue equilibriums might go through tax obligations and fines. The main advantage of an IUL policy is its possibility for tax-deferred development. This suggests that any type of incomes within the plan are not strained till they are withdrawn.

Conversely, an IUL policy may not be one of the most appropriate financial savings prepare for some people, and a typical 401(k) might prove to be much more beneficial. Indexed Universal Life Insurance Policy (IUL) policies use tax-deferred development capacity, defense from market recessions, and fatality advantages for recipients. They permit policyholders to earn interest based on the performance of a stock exchange index while securing against losses.

401(k) Vs. Indexed Universal Life (Iul) Insurance: Pros And Cons

Companies may also provide matching payments, further increasing your retired life cost savings potential. With a traditional 401(k), you can decrease your taxed income for the year by adding pre-tax dollars from your income, while additionally benefiting from tax-deferred growth and employer matching payments.

Lots of employers additionally give matching contributions, efficiently providing you free money in the direction of your retirement. Roth 401(k)s function similarly to their standard counterparts however with one trick distinction: tax obligations on payments are paid in advance rather than upon withdrawal during retirement years (iul divo). This means that if you expect to be in a higher tax obligation bracket during retired life, adding to a Roth account might save money on taxes with time contrasted with investing solely with conventional accounts (source)

With lower management costs generally compared to IULs, these sorts of accounts enable capitalists to conserve cash over the lengthy term while still gaining from tax-deferred development potential. Additionally, many popular affordable index funds are readily available within these account types. Taking distributions prior to getting to age 59 from either an IUL policy's cash value through fundings or withdrawals from a conventional 401(k) plan can result in negative tax effects otherwise dealt with carefully: While obtaining versus your policy's cash worth is generally thought about tax-free up to the amount paid in costs, any kind of overdue loan equilibrium at the time of death or plan surrender may be subject to revenue tax obligations and fines.

How Indexed Universal Life (Iul) Can Be Used Alongside A 401(k)

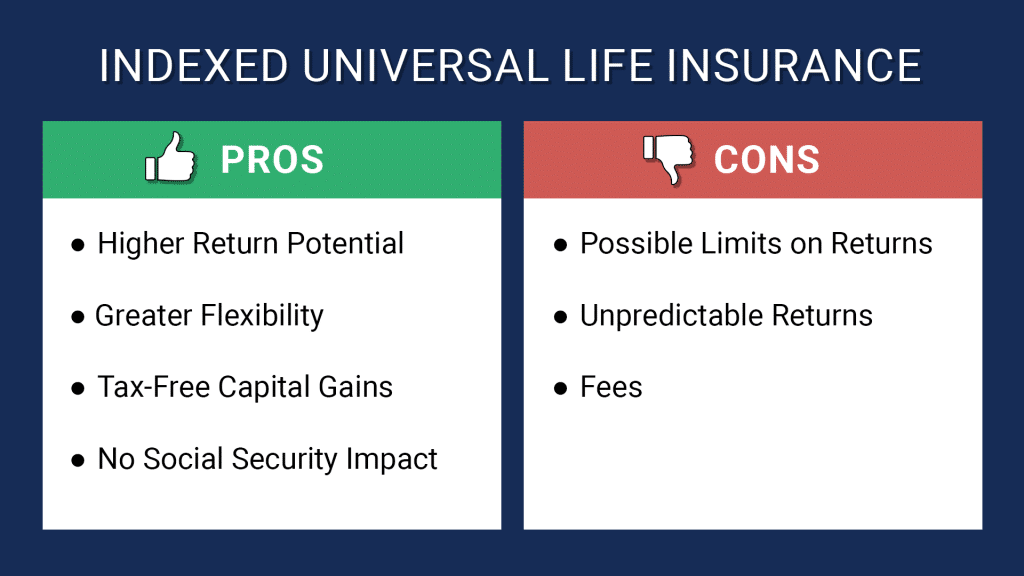

A 401(k) supplies pre-tax investments, employer matching payments, and potentially more investment options. The drawbacks of an IUL include higher management costs contrasted to conventional retired life accounts, limitations in investment choices due to plan restrictions, and potential caps on returns throughout solid market efficiencies.

While IUL insurance coverage might show important to some, it's crucial to understand exactly how it works before buying a policy. Indexed universal life (IUL) insurance coverage policies supply better upside potential, flexibility, and tax-free gains.

As the index moves up or down, so does the price of return on the money value part of your plan. The insurance coverage company that releases the policy may use a minimal guaranteed rate of return.

Economists commonly recommend having life insurance policy coverage that amounts 10 to 15 times your annual revenue. There are several disadvantages related to IUL insurance coverage that movie critics are fast to point out. For example, a person that develops the policy over a time when the market is carrying out badly might finish up with high costs payments that do not add at all to the cash money value.

Other than that, bear in mind the complying with other considerations: Insurer can set participation prices for just how much of the index return you get every year. As an example, allow's say the plan has a 70% participation price (Tax Benefits of Indexed Universal Life vs 401(k)). If the index expands by 10%, your cash value return would be just 7% (10% x 70%)

On top of that, returns on equity indexes are frequently capped at a maximum amount. A policy might say your optimum return is 10% annually, regardless of exactly how well the index executes. These constraints can limit the actual price of return that's credited towards your account yearly, despite exactly how well the policy's hidden index performs.

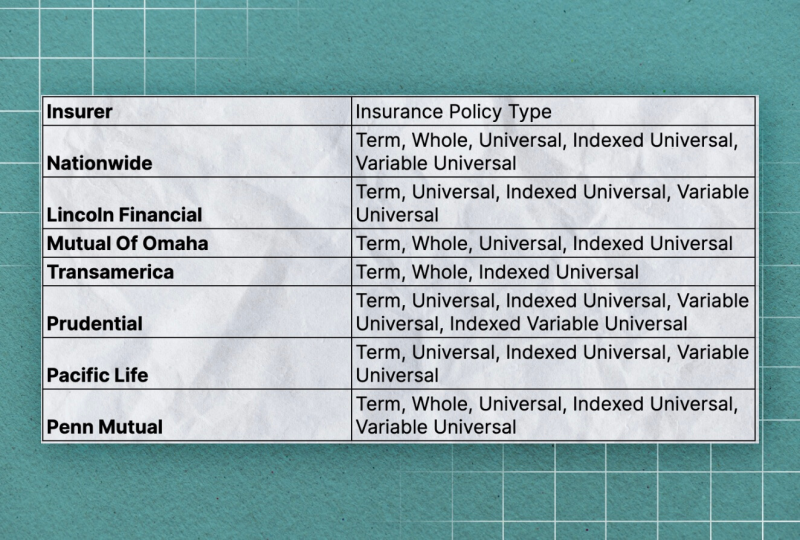

Nationwide Iul Review

It's important to consider your individual risk tolerance and financial investment objectives to guarantee that either one lines up with your overall approach. Entire life insurance policy policies typically include a guaranteed rate of interest with predictable exceptional amounts throughout the life of the plan. IUL plans, on the various other hand, offer returns based upon an index and have variable costs gradually.

There are many other kinds of life insurance policy policies, clarified listed below. provides a fixed benefit if the insurance policy holder dies within a set duration of time, generally in between 10 and three decades. This is one of the most economical sorts of life insurance policy, in addition to the most basic, though there's no cash money worth buildup.

Iul Com

The policy acquires worth according to a dealt with schedule, and there are fewer charges than an IUL plan. A variable policy's money worth might depend on the performance of particular supplies or various other safety and securities, and your premium can likewise change.

Latest Posts

Allstate Futuregrowth Iul

New York Universal Life Insurance

Group Universal Life Insurance Definition